Original Post: March 24, 2017

Should I rent or should I own? There are personal and financial factors which spur a move in one direction or another. Changes in household composition (marriage, divorce, birth, death) or work (relocation, retirement, income) result in different needs for space and function and demands on financial resources. Also at issue are market exigencies, such as the actual availability of attractive inventory.

Chicago continues to replenish its luxury rental market: 16,000 units built or planned, 2016 through 2018, most in Chicago’s core, particularly River North, but also in communities along feeder lines. The cost of a luxury rental is about $3.33/sq.ft. or $3000/month for a 900 sq.ft. 2-bedroom apartment. Analysts believe the City’s rental market is cresting, but developers hope Millennials continue their interest in City living, companies continue to locate in the City’s core, rents reach $6 or $7/sq.ft., and some renters are willing and able to pay $10,000/month for ultra luxurious, though small, apartments. Their caveats are longer absorption rates and flatter rent appreciation for existing stock. (Facts and trends drawn from a panel discussion, “The Apartment Rental Market” hosted by Ely Chapter, Lambda Alpha Int’l, Chicago, 2/15/17.)

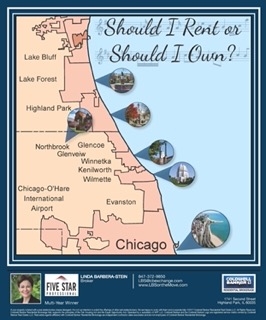

Ripples from Chicago’s successful history with rentals just now reached its suburban North Shore, (See graphic above.) I surveyed six new developments: NorthShore 770, Northbrook (built 2016, 342 units); Residences at Wilmette (expected 2017, 75 units); Laurel Apartments, Highland Park (built 2017, 30 units); McGovern House, Highland Park (expected 2017, 73 units); Winn, Winnetka (expected 2018, 40 units); and Kelmscott Park, Lake Forest (expected 2018, 111 units). The total number of units is modest compared to the City, so too the cost of a luxury rental, about a dollar less than the City, ranging from $1.98-$2.98/sq.ft.

In Highland Park, from the same developer of new construction on adjacent parcels, a 1045 sq.ft. 2-bedroom 2-bath unit (1 garage space) can be rented for $2390/month or purchased for $339,500. Cost per month to purchase (assuming a conventional 15-year fixed mortgage, 75% loan to value, 3.25% rate and adding property taxes) is similar, $2477/month. However, ownership carries a fuller bundle of rights, property taxes are a federal income tax deduction, equity ownership increases and property value likely appreciates over time.

To answer the question: If your living needs and income are stable and predictable and you saved a down payment, ownership is an investment in your future, If not, renting is a perfect solution to short-term or transitional housing needs.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link